Ways to modify your car

Ever considered kitting out your car with some new alloy wheels? Thought about adding some extra headlights? Or been tempted to tune up the engine?

Ever considered kitting out your car with some new alloy wheels? Thought about adding some extra headlights? Or been tempted to tune up the engine?

A modification can be a great way to personalise your car, and even improve its performance – there is a downside though, it can quickly bump up the cost of your car insurance.

While many of us don’t go as far as ‘Pimp Your Ride’ in the changes we make to our vehicles, it’s still important to consider a potential downside – namely, that vehicle modifications can increase the cost of your car insurance.

Even if you’re not looking to ‘pimp’ your ride, you may find just a slight modification is enough to push up the price of cover.

What is a car modification?

A car modification is a change made to a vehicle so that it differs from the manufacturer’s original factory specification. The changes can be made to improve performance, aesthetics, or be purely functional.

How do modifications change the price you pay for car insurance?

Insurance is based upon risk, and when quoting for cover insurers use a number of factors before arriving at a price.

- Risk of Accident – Modifications that change the look and performance of your vehicle are assessed by insurers to be a higher accident risk. These include engine changes, sports seats, body-kits, spoilers, etc.

- Risk of Theft – Some modifications, such as phone kits or performance modifications, also increase the chance that your vehicle is broken into or stolen.

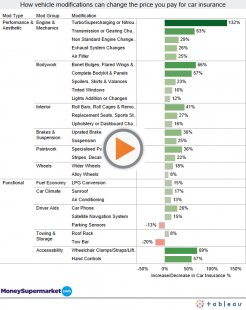

Analysing information on 2.3 million modified vehicles, our number-crunchers produced the price guide below to show the effect each type of modification has on the cost of car insurance costs.

In general, many of the performance and aesthetic changes made to vehicles will increase the cost of cover. Interestingly, insurers even rate specialist paint and decals as a higher risk, and ‘go faster stripes’ and rally numbers are cause for concern when considering the cost of cover.

On the other hand, performance and aesthetic changes such as tinted windows and alloy wheels are both more commonplace and considered low risk.

There are some functional car modifications, such as aftermarket fitted satnavs and phone kits, can also increase insurance costs because they are considered a high theft risk, whereas others can reduce premiums.

For example, parking sensors mean you are less likely to have a prang when reversing, while having a tow bar means that when hooked-up you are spending more time driving at a moderate pace.