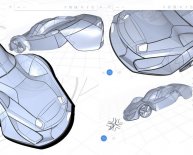

Car Modifying parts

Your $5, 000 Honda Civic is only a new exhaust, some coilovers and a sound system away from becoming a $10, 000 Honda Civic.

A well-modded car is a work of art. It looks right. It sounds right. It goes right. But an everyday car that’s come to life with the application of hundreds of your hours and thousands of your dollars is still just an everyday car to your insurance company.

Here’s how to decide whether you need to go the extra mile. Below are answers to some of the most common questions.

Are my car parts covered automatically?

If you have a liability-only policy - the very cheapest, bare-bones policy - you have zero coverage on your vehicle. All you have is some protection from lawsuits if you hit someone.

To have your car repaired or replaced, you have to buy collision and comprehensive insurance. Collision fixes physical damage to your own car when you hit something (or someone who is uninsured hits you). Comprehensive covers theft and damage from flooding, hail, falling objects, vandalism and animal strikes. Both of them will pay the actual cash value of your car if it’s totaled. But the actual cash value of your car is the cost to replace it with one similar to what you were insuring.

With some insurance companies, collision and comprehensive coverage will automatically include some small amount for aftermarket parts, typically $1, 000. Even so, it’s still a good idea to take photos and keep receipts for the improvements you make.

With other policies, no aftermarket parts are covered.

If you’ve added a lot of aftermarket parts and haven’t bought special coverage, you’re not covered. If a thief steals your 22s, you’re rolling on factory steelies when the insurance check comes in.

What kind of coverage do I need for aftermarket parts?

Coverage for custom parts and equipment (CPE) - that’s how it’s known - isn’t particularly expensive, especially if you’re under 25 and already paying the highest rates you’ll see in your life. Most drivers will pay only a few dollars a month for $5, 000 coverage.

But you can’t buy CPE by itself; you must also carry collision and comprehensive.

What is agreed-value or stated-value coverage? Why would I use this?

An agreed-value policy means you and your insurance company agree ahead of time exactly what the payout will be if your car is stolen or totaled. Your premium is based on that amount.

If you say your Honda Civic is worth $50, 000, you will pay a premium reflecting that, and the insurance company will write you a check without any haggling.

Agreed-value policies are typically used for rare or one-of-a-kind custom cars, where a replacement is difficult or impossible to find. Owners of tuner cars that go much beyond bolt-on parts might consider such coverage.